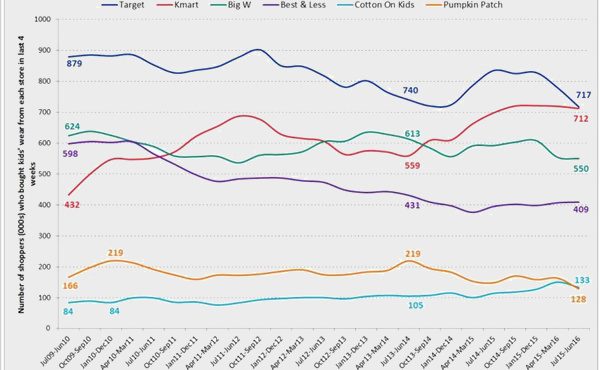

Following the news of Pumpkin Patch’s receivership, research shows that the number of people buying children’s clothing at the retailer’s Australian stores and online has steadily been declining for the past two years.

According to Roy Morgan Research, Pumpkin Patch used to average close to 220,000 people that bought at least one item in an average four weeks, however, since 2014 this has been eclipsed by Cotton On Kids (133,000 vs 128,000) and Kmart (712,000).

“Besides the gradual influx of internationals, the main factor influencing Pumpkin Patch’s loss of customers—not to mention falling shopper numbers at Best & Less, Big W and Target—is almost certainly the dramatic rise of Kmart as a children’s-wear destination (part of a larger turnaround at the hands of CEO Guy Russo),” explains Angela Smith, general manager consumer products Roy Morgan Research.

“With its cheap-and-cheerful kidswear range and a series of vibrant, attention-grabbing TV ads promoting it, Kmart is successfully luring more and more shoppers away from the competition (not only Pumpkin Patch, it should be added) with its fun, ‘fast-fashion’ approach.”

Indeed, Pumpkin Patch isn’t the only children’s wear retailer to have lost customers, Target, Big W and Best & less have lost ground too, even though all these retailers score high in the satisfaction stakes (between 80-90 per cent according to Roy Morgan Research).

“The children’s-wear sector is a very different place now than it was in 1990 when the New Zealand-owned Pumpkin Patch was established. Online shopping didn’t exist, and international players like H&M, Aldi and Zara were yet to disrupt the local market,” says Smith.

While international players like H&M, Uniqlo and Zara have already made a huge impact on adult fashion retail, they’re not yet dominant in the kidswear scene. However, in any given four weeks, some 35,000 Australians buy children’s clothing at Aldi, 15,000 buy at Zara and 45,000 buy from H&M. That’s 95,000 shoppers who might otherwise have been shopping at Pumpkin Patch.

“These days, retailers are faced with a much more crowded and competitive landscape; it’s inevitable that not every business will thrive in these ever-changing conditions.

“Renowned for its high-quality, long-lasting garments rather than its low prices, Pumpkin Patch’s premium approach may have served them extremely well in the past―and will always have its devotees―but sadly, in this increasingly high-turnover, budget focused retail landscape, it lost its competitive edge…”

By Marion Gerritsen